A complete infrastructure to deliver telecom services efficiently

Fast customer enrollment and KYC

Use strong customer identification processes (KYC) via OCR data capture or biometry, to quickly onboard new customers when registering SIM cards or subscribing to new services. Ensure robust identity verification, prevent fraud, and stay fully compliant with industry regulations, all while providing a seamless onboarding experience.

Streamlined sales of SIM cards and services

Ensure your agents can easily sell SIM cards, do SIM swaps, top up airtime and data, and resell additional services, such as energy, insurances, and internet subscriptions. Expand your service offerings to provide a seamless customer experience at every touchpoint and increase revenue.

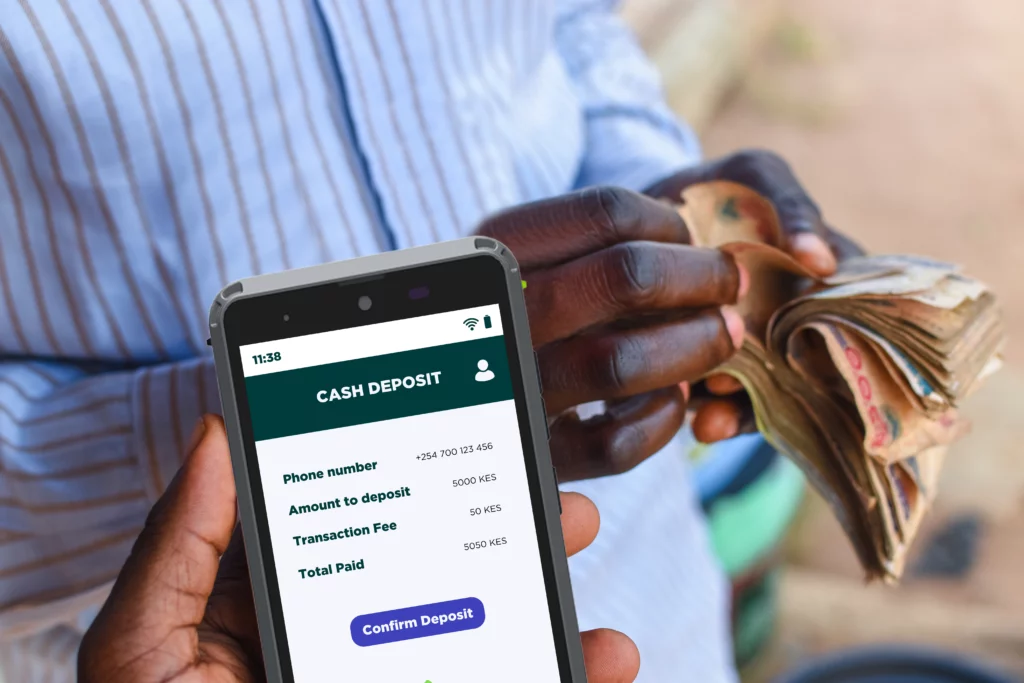

Secure cash-in and cash-out transactions

Enable your customers to deposit and withdraw funds from their Mobile Money accounts or digital wallets, expanding financial access in underserved areas and fostering financial inclusion. Leverage Famoco solutions to ensure compliance with regulatory standards and boost transaction efficiency.

Sales performance tracking and management

Equip your area managers and supervisors with devices that enable them to efficiently manage and oversee points of sale. With real-time tools at their disposal, supervisors can ensure optimal agent allocation across territories, balancing resources to maximize operational efficiency and customer satisfaction.

Our impactful metrics from the field

From efficient customer enrollment to secure device management, our technology supports telecom operations worldwide with proven results.

devices on the field

countries covered

year device lifespan

years of expertise in KYC

Our technologies in action

See how our solutions drive success for telecom operators